Gabby Asare Otchere-Darko has asked former President John Mahama to “shush” because the Akufo-Addo administration has been kind to him.

The attack from Gabby, who is believed to have the ears of the President, comes after the former President waded into claims that the NPP government intends to increase VAT in the upcoming mid-year budget review scheduled for next week. The speculation over the proposed increase in tax was started by Mr. Otchere-Darko in a Facebook message on Friday.

“The Ghanaian business sector has never experienced such difficult times in the history of the 4th Republic. Akufo-Addo’s proposed new taxes would cripple businesses further and also defeat his much-touted mantra of “from taxation to production,” the former leader said in a Tweet.

In an apparent reaction to Mr. Mahama’s tweet, the former head of the Danquah Institute said the NPP government will find ways to keep faith with the Ghanaian people without increasing the economic burden on the citizenry.

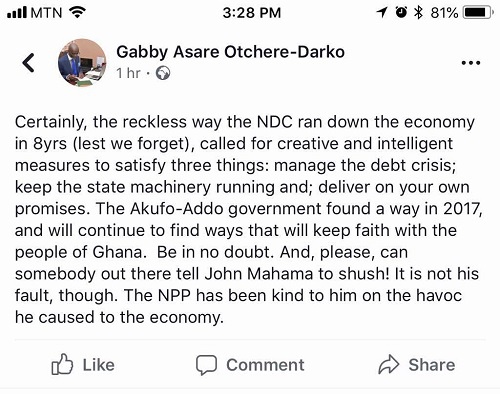

“Certainly, the reckless way the NDC ran down the economy in 8yrs (lest we forget), called for creative and intelligent measures to satisfy three things: manage the debt crisis; keep the state machinery running and; deliver on your own promises. The Akufo-Addo government found a way in 2017, and will continue to find ways that will keep faith with the people of Ghana. Be in no doubt. And, please, can somebody out there tell John Mahama to shush! It is not his fault, though. The NPP has been kind to him on the havoc he caused to the economy,” Gabby wrote on Facebook.

The government is considering introducing taxes such as;

1. An increase in Communications Service Tax from 6% to 12%?

2. A mandated minimum corporate tax

3. An expanded stabilisation tax?

4. Collaterising royalties from minerals to enable government raise loans

5. Increased social security (SSNIT) contributions to the NHIS?

6. A Financial Service Tax

The government is also likely to increase the Value Added TaX (VAT) from 17.5% to 21% in the mid-year budget set to be presented to Parliament on Thursday, July 19, 2018.

The country’s Financial Management Administration Act requires the finance minister to come before Parliament not later than July 31, prepare and submit to parliament a Mid-Year Fiscal Policy review.

This often allows the finance minister the opportunity to review the targets, especially when it comes to the review,

a. A brief overview of recent Macroeconomic Developments of Governments

b. Update of Macroeconomic forecast undertaken by the government

c. Analysis of total revenue and expenditure and performance for the first 6 months of this year

d. Also where necessary, revise the Medium Term Budget outlook the budget outlook and Expenditure framework.