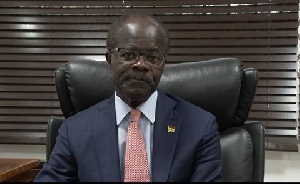

Chairman of Groupe Nduom, Dr Papa Kwesi Nduom

Chairman of Groupe Nduom, Dr Papa Kwesi Nduom

Groupe Nduom Limited has reacted to the revocation of license of Blackshield Capital Management (formerly Gold Coast Fund Management) saying it will “continue to pursue legal action to collect funds owed in settlement of Blackshield’s client liabilities.”

In a statement signed and issued by the Chairman and CEO of Groupe Nduom, Dr Papa Kwesi Nduom said the company was disappointed that SEC took the revocation of license action without responding to the numerous requests to assist Blackshield in retrieving funds owed by various government of Ghana entities and “review our plans to migrate customers into a private sector solution to Blackshield’s liquidity problem.”

The Securities and Exchange Commission (SEC) on Friday, November, 08, 2019 revoked the operating licences of 53 investment companies including Blackshield Capital Management (formerly Gold Coast Fund Management).

The move, the regulator says is to protect the integrity of the securities market and investors.

According to the SEC, it has had a number of engagements with Blackshield including Hearings pursuant to section 19 of Act 929 and decisions have been issued by the SEC against Blackshield with directives to take steps to comply and resolve its regulatory infractions, all to no avail.

But according to Groupe Nduom, the entity representing the interests of the majority shareholders and founders of Blackshield, the SEC’s assertion that 99.41 per cent of its funds were placed in one investment vehicle, for instance, was “misleading and/or untrue.”

The 32 firms whose operating licenses have been revoked included Blackshield Capital Management (formerly Gold Coast Fund Management), All-time Capital Limited, Apex Capital Partners, Axe Capital Limited (Formerly United Asset Management, and Intermarket Asset Management Limited (formerly CDH Asset Management).

Twenty-one other firms were already out of business before the decision to revoke their licences was taken.

These actions were taken pursuant to Section 122 (2) (b) of the Securities Industry Act, 2016 (Act 929 or “the Act”) which authorises the Securities and Exchange Commission to revoke the licence of a market operator under any of the following circumstances:

(a) If it is wound up;

(b) It ceases to carry on the business for which it was licensed;

(c) If the Commission has reason to believe that the licensed body or any of its directors or employees has not performed its functions or the functions of directors efficiently, honestly and fairly;

(d) If the licensed body contravenes or fails to comply with a condition or restriction applicable in respect of the license or any other provision of Act 929; and

(e) If the licensed person fails to commence business within 6 months of being granted a licence,” the SEC said in a statement.