Cocoa is a key export commodity for Ghana and Ivory Coast

Cocoa is a key export commodity for Ghana and Ivory Coast

The government’s plan to finance cocoa purchases through domestic bond issuance is drawing mixed reactions from market analysts, with debate centering on whether the capital market can absorb what could amount to about US$1 billion to US$1.5 billion annually without distorting liquidity or raising yields.

The proposal, announced by Finance Minister Dr Cassiel Ato Forson, forms part of broader reforms at the Ghana Cocoa Board after losses of more than US$1 billion linked to production shortfalls and contract rollovers.

Under the new framework expected from the 2026-2027 season, COCOBOD will issue cedi-denominated cocoa bonds to create a revolving fund for bean purchases, replacing reliance on offshore syndicated loans.

A senior market analyst at one of Ghana’s largest investment firms said current liquidity conditions suggest the domestic market can absorb cocoa bond issuance, at least in the near term.

“If you look at the demand levels we get for T-bills on a weekly basis, I believe that can be comfortably dealt with,” the analyst said, pointing to recent auctions where more than GH¢13 billion in bids were rejected. He added that large coupon payments and interbank liquidity injections indicate funds are available.

“In terms of funds availability, the market conditions currently seem supportive,” he said, though he warned that once the Treasury intensifies bond issuance or banks expand lending, competition for funds could increase.

Kwadwo Acheampong, a market analyst, took a more cautious stance. He said Ghana’s capital market is not yet sufficiently deep to handle cocoa bond issuance on its own and recommended a gradual five- to eight-year transition away from US dollar syndicated loans to reduce currency exposure.

“I believe our capital market is not currently sufficiently deep and cocoa bond issuances should not be handled solely on our capital markets,” Acheampong said.

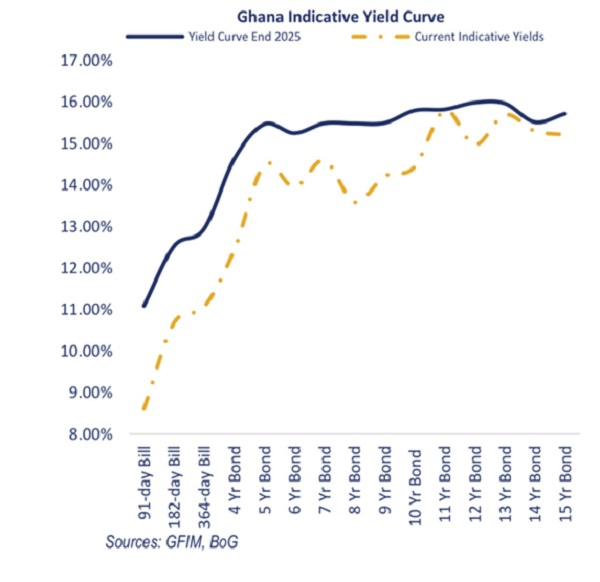

EcoCapital Investment also flagged potential crowding-out risks, warning that recurring large-scale issuance could absorb liquidity that would otherwise go into Treasury securities, pushing yields higher, especially in the one- to five-year segment.

“This is not just a COCOBOD issue once it becomes a macro-financial stability issue,” the firm said.

Pricing and Margin Pressure

Analysts agree that pricing will be decisive. EcoCapital estimates cocoa bonds could price 200 to 400 basis points above comparable government securities, reflecting production risk, price volatility and governance concerns. If government bonds trade near 18 percent, cocoa bonds could land between 20 percent and 22 percent.

The investment analyst said investors will scrutinize credit credibility, noting that COCOBOD previously restructured obligations.

“Investors are still hurting from that default,” he said, adding that balance sheet repair must precede issuance.

He compared the proposed domestic funding to past syndicated loans priced around eight percent in US dollar terms. Adjusted for moderate depreciation, that implied an effective cost near 16 percent in cedi terms.

“If cocoa bond comes onto the market, you expect that it doesn’t do worse than 16 percent,” he said. “Otherwise, you might start to question the cost of the funding.”

EcoCapital warned that elevated domestic yields above the low-20 percent range could materially strain operating margins, particularly if global cocoa prices soften.

Risk Transfer and Systemic Exposure

On systemic risk, Acheampong said liquidity and interest rate risks for banks and pension funds are real but may not become destabilising if issuance is well calibrated and multinational traders continue advancing funds.

EcoCapital was more cautious, noting that heavy exposure by banks and pensions could concentrate risk in a single commodity and issuer. In the event of another production shortfall or global price downturn, institutional portfolios could face mark-to-market losses.

The investment analyst described the shift as a transfer of risk from foreign lenders to domestic investors.

“When they were borrowing from international lenders, the international lenders were carrying the COCOBOD risk,” he said. “Now the domestic market will carry that risk and ultimately commodity market risk.”

Currency and Processing Strategy

Analysts also highlighted currency dynamics. COCOBOD earns export revenues in US dollars but would service bonds in cedis. Acheampong said exchange rate management remains critical to maintaining fair producer pricing and operational stability.

The investment analyst argued that the 2025 cedi appreciation largely corrected prior excessive depreciation and expects more moderate currency movements ahead.

On the policy to allocate at least 50 percent of beans to local processing, he said higher-value exports could increase foreign exchange earnings over time, though benefits will not be immediate and execution risks remain.

The analysts surveyed agree that liquidity appears available, but sustainability depends on pricing discipline, balance sheet repair and production stability. Whether cocoa bonds deepen the country’s capital market or crowd out the Treasury curve will depend on structure, timing and investor confidence.