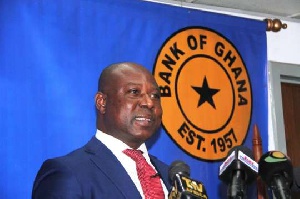

Dr. Abdul-Nashiru Issahaku - Governor of the Bank of Ghana

Dr. Abdul-Nashiru Issahaku - Governor of the Bank of Ghana

The Bank of Ghana (BoG) has closed down two illegal micro-finance institutions, Agro Development Fund Services Limited and Hebron Financial Investment Limited.

The two institutions were closed down on Tuesday for flouting the Specialized Deposit Taking Institutions Act, 2016 (Act 930) and Foreign Exchange Act, 2006 (Act 723).

The Central Bank, in a statement said, “The bank wishes to state that ADFSL has been closed down until further notice.

“This decision is in furtherance of Section 20(2) (g) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930). Bank of Ghana has investigated ADFSL thoroughly and has concluded that its activities are contrary to Section 4(5) (a) of Act 930.

With regards to Hebron Financial Investment Limited (HFIL) located at Mayflower Building, Community 10, Tema, the bank said, “It has come to the attention of the Bank of Ghana that HFIL is engaging in unauthorized online foreign exchange trading business contrary to Section 3(1) of the Foreign Exchange Act, 2006 (Act 723).

“Bank of Ghana has conducted investigations into the operations of HFIL and has concluded that the said company is not authorized to engage in any form of foreign exchange business.

“Further to this, the Bank of Ghana has directed HFIL to close down its operations forthwith”.

The Bank warned that anyone who does business with either Agro Development Fund Services Limited or Hebron Financial Investment Limited does so at his/her own risk.

Owners Face Sanction

Meanwhile, the Director of Communications of BoG, Bernard Otabil has disclosed that the Central Bank would duly sanction owners of the two institutions, whose activities have been halted for operating illegally.

He said the bank is currently working with the security agencies to investigate persons arrested in connection with the matter.

Speaking in an interview with Citi News, Mr. Otabil, said the Criminal Investigations Department (CID) of the Ghana Police Service made some arrests and that some people were requested to give statements to that effect.

“It is not the end of it all; some of the directors were handed over to the CID and are assisting in further investigations,” he said.

Mr. Otabil said the sanctions would sanitize the financial space, stating that “we moved in with the help of the general public to bring all the perpetrators to book. Our idea is that we protect the general public from the activities of such charlatans.”