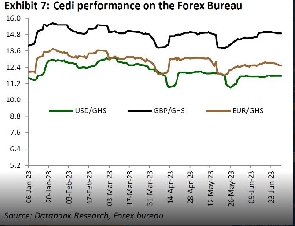

A graphic representation of the Cedi's performance from January to June 2023

A graphic representation of the Cedi's performance from January to June 2023

After experiencing a volatile first half of 2023 (H1-23) marked by losses, the cedi is anticipated to sail smoothly in the latter half of the year – driven by significant foreign exchange (FX) inflows and a recovery in investor confidence.

The country is poised to receive substantial funding, with US$900million from the World Bank and a potential second tranche of US$600million from the IMF in November 2023, following a successful review in September 2023. Moreover, Ghana’s external debt restructuring is progressing steadily and is on track to be concluded in H2-23.

In its review of the currency market, Databank, an asset management company noted that the cedi will remain range-bound and trade between GH¢10.9 and GH¢11.1 to US$1 for the Bank of Ghana (BoG) interbank reference rate by the end of the year.

“We forecast the GH¢ to remain range-bound and trade around GH¢11.0/US$ (±GHp10) for the BoG interbank reference rate to end the year. We believe the conclusion of external debt restructuring will bolster investor confidence and help attract portfolio inflows, which will help support FX liquidity on the market,” Databank said.

Additionally, the expected inflows from the cocoa syndicated loans, approximately US$2billion, are expected to bolster FX reserves and strengthen the intervention capabilities of the central bank; thus supporting GH¢ stability.

The foreign exchange market has maintained relative stability during the first six months of 2023, supported by positive market sentiments derived from the IMF’s disbursement of the ECF first tranche of US$600million, forex purchases from the mining and oil sectors, and weakened demand.

While the cedi depreciated by 20.6 percent against the US dollar in January 2023, it has remained generally stable since then with a cumulative depreciation of 1.8 percent between February and June 2023.

Government’s debt service is not expected to significantly impact foreign investor holdings of four maturing domestic bonds in H2-23, as they constitute only 2 percent of the outstanding bonds. As a result, the cedi is expected to remain stable in H2-23, and the central bank aims to meet its US$120million target for the Bulk Oil Distribution Companies (BDC) forex (FX) forward auction in Q3-23.

Despite the cedi’s impressive performance since February 2023, concerns remain about the reserve buffer’s vulnerability to shocks – with gross reserves (adjusted for petroleum funds and encumbered assets) estimated to cover only 0.8 months of imports by December 2023. This weak reserve cushion poses a threat to the local unit’s near-term outlook.

The upcoming maturity of the Aug-2023 Eurobond with a face value of US$148.76million is expected to put significant strain on FX reserves and limit the central bank’s sell-side interventions.

In a period of increased volatility, though unlikely, the GH¢ could be subject to speculative attacks. Additionally, Saudi Arabia’s decision to reduce oil production by a million barrels daily could increase oil prices and Ghana’s import bills – exerting depreciating pressures on the cedi, as noted by Databank.

Despite these risks the overall outlook for the cedi appears positive, with the expected funding and debt restructuring contributing to improved investor confidence and stability in the currency market.