Cars, appliances and student loans can also be accessed in a low interest rate environment

Cars, appliances and student loans can also be accessed in a low interest rate environment

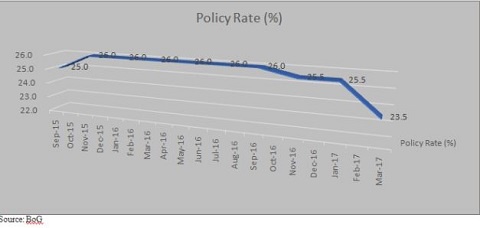

In slashing the policy rate in November 2016 from 26% to 25.50% and subsequently by 200 basis points in March 2017 to 23.50%,the Bank of Ghana (BoG), amongst others seek to boost consumer spending and increase business investments in order to spur economic growth.

By these actions, short term rates are curtailed so as to try to achieve the intended purposes.

Interest rate is a major tool governments use in ailing economies to regain business confidence.

Here is a look at some effects of the reducing interest rates on locals and businesses:

1. Lowering interest rates makes borrowing more affordable. Businesses can access loans for expansion which should have a positive impact on numbers in employment.

2. There is also a boost in the bottom lines of companies listed on the stock market which will increase dividend pay out to shareholders.

3. Low interest rates help to improve the balance sheet of banks. Non-Performing loans tends to be on a decline as consumers ability to pay back loans increases.

1. Loans can also be accessed at low rates and reinvested in equities for a higher rate of return.

2. Low interest rates could encourage first time home buyers to purchase a cedi denominated mortgage and refinance it at a cheaper rate.

Cars, appliances and student loans can also be accessed in a low interest rate environment.

However, low interest rates have their negative side also. Some include:

1. Short term investors are hard hit because of low returns they are getting from their savings; return may indeed be negative. Unless inflation decrease correspondingly at a higher rate.

2. Also, retired persons who need to pay bills based on their investment income are left with little options of generating income.

3. When rates are low, investors in general seek for riskier investments that should yield higher yield; however can lead to loss of principal.

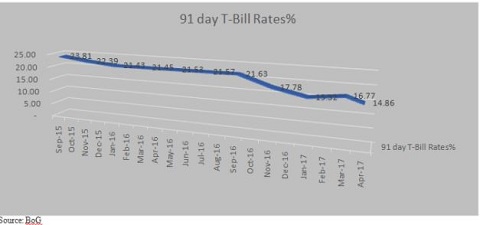

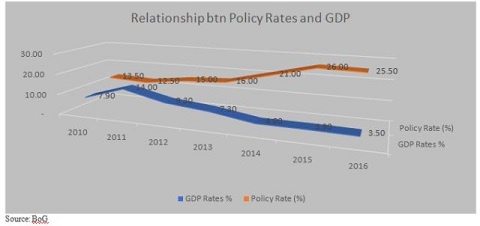

According to the Bank of Ghana, whiles the policy rate remained at 13.5% during the first quarter of 2011 average interest rates on both the short and medium term segments declined. Within that period average interest rate on the 91-day, 182 and 1-year Treasury bills and notes declined from 12.8%, 12.68% and 12.7% to 12.11%, 12.51% and 12.50% respectively.It is expected that the lower the rates go, the better it is for economic activity, as shown in the GDP figures below.

Whiles low interest rates is the preferred path by most economists, it is imperative to state that rates kept at low levels over a long period of time gives governments limited options in selecting alternative policies to boost economic growth,that is if the economy continues to be weak.

By: Kofi Busia Kyei

Financial Analyst

kofibusia@outlook.com