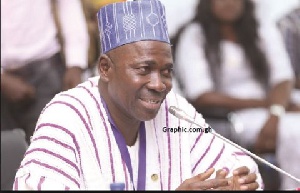

Frank Fuseini Adongo, Upper East Acting Regional Minister

Frank Fuseini Adongo, Upper East Acting Regional Minister

The Upper East Acting Regional Minister, Frank Fuseini Adongo, has cited tax evasion, under declare incomes and revenues, among others as some of the major factors that are likely to affect Ghana’s efforts of making significant impact in the attainment of the Sustainable Development Goals(SDGs).

The Acting Regional Minister made the observation in a speech read for him by the Assistant Director of Administration of the Regional Coordinating Council , Ms Yvonne Wepela Wonchua, at a Regional Stakeholder Sensitization forum on Tax Justice, held in Bolgatanga on Saturday .

The forum which was organized by the Upper East Regional Tax Justice Coalition in collaboration with Rural Initiative for Self-Empowerment-Ghana (Rise Ghana), a Non-Governmental Organization (NGO) and sponsored by Action Ghana (AAG), attracted stakeholders including the Ghana Revenue Authority, Traders, Civil Society Organizations, the clergy, the Media among others.

The Acting Regional Minister who is also the Member of Parliament of the Zebilla Constituency, observed that not only would negative acts such as tax evasion, under declare incomes and revenues would affect Ghana’s efforts in the attainment of the SDGs, but would also affect the President’s vision of making Ghana beyond Aid.

“One key factor to the achievement of the SDGs and moving Ghana beyond Aid will be the availability of fiscal resources to deliver interventions such as social protection, social services and infrastructure as embedded in the SDGs,” he stressed.

The Acting Regional Minister stated that a significant portion of the needed resources for the implementation of programmes and policies towards achieving the SDGs and Ghana beyond Aid is expected to come from taxes and stressed the need for the widening of the tax net.

He stated that although the government had initiated a number of measures including the merging of the tax collection agents into one umbrella called the Ghana Revenue Authority (GRA), the introduction of the tax stamps, the tax identification system, and the paperless system at the ports among others, there was the need for all Ghanaians to honour their tax obligation strictly to enable the government realized its dreams.

Whilst challenging the GRA to leave up to expectation, the Acting Regional Minister also entreated the media to go beyond just reporting to include exposing people who wilfully evade, misappropriate and squander accrued revenues from mobilized taxes from Ghanaians.

Mr Adongo commended RISE-Ghana and AAG for organizing the programme to sensitize the stakeholders on the relevance of the Tax Justice system to nation building and pledged the Regional Coordinating Council’s commitment to the implementation of the Tax Justice System. “The Regional Coordinating Council is committed to supporting every effort towards the implementation of the tax justice system that will improve revenue mobilization to achieving the SDGs and the Ghana Beyond Aid Project by the President, Nana Addo Dankwa Akufo-Addo”, the Acting Regional Minister indicated.

The Executive Director of RISE-Ghana, Mr Awal Ahmed Kariyama, indicated that the Government alone cannot spearhead the mobilization of the needed revenues to implement programmes towards the attainment of the SDGs, Ghana Beyond Aid and the National Development Agenda.

He explained that it was against this background that the NGO with support from AAG was complementing government’s efforts at educating citizenry on the need to avoid tax evasion and under declare incomes and revenues.

The forum also afforded the stakeholders the opportunities to ask series of questions pertaining to tax payments and were schooled by the staff of the GRA Some of the stakeholders at the sensitization forum on tax justices held in Bolgatanga of the Upper East Region.