The Ghana Revenue Authority (GRA)

The Ghana Revenue Authority (GRA)

The Ghana Revenue Authority (GRA) has dismissed fears that the newly introduced Value Added Tax (VAT) framework will trigger price hikes or create unfair competition, particularly in the spare parts market.

In a press statement sighted by GhanaWeb Business on February 10, 2026, and issued by its Communication and Public Affairs Department, the Authority responded to concerns raised by the Abossey Okai Spare Parts Dealers Association, which argued that the VAT changes under the Value Added Tax Act, 2025 (Act 1151), could place an extra burden on traders and push up consumer prices.

The GRA said such claims stem from a “fundamental misunderstanding” of how the revised VAT system functions.

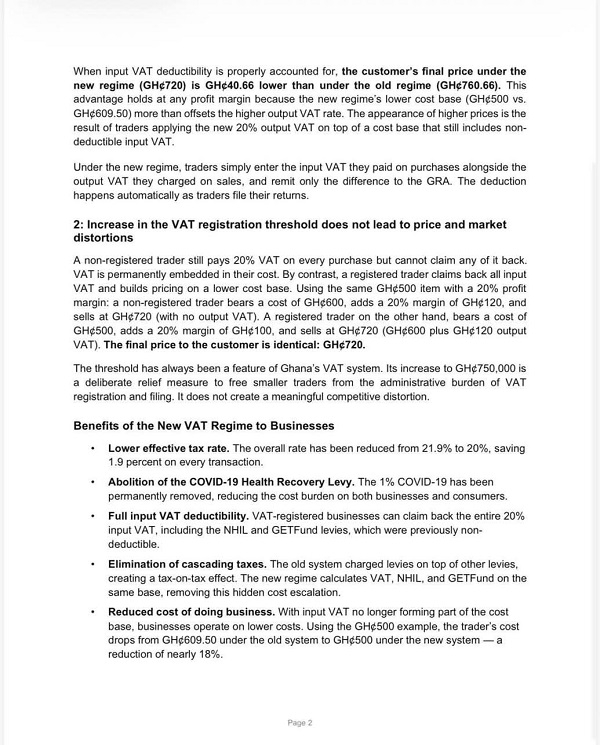

Under the former 4 percent flat rate arrangement, traders paid 21.9 percent VAT on their inputs. This amount could not be reclaimed, meaning it was absorbed into the cost of goods before sales were even made.

EXPLAINER: All you need to know about GRA's new VAT regime

Under the new system, the standard VAT rate stands at 20 percent, but businesses can now fully deduct the VAT paid on their inputs. The Authority explained that this adjustment lowers the actual cost base for traders.

To illustrate its point, the GRA used the example of a GH¢500 product with a 20 percent profit margin. It stated that under the old structure, the final price to consumers would reach GH¢760.66. Under the new arrangement, the same item should retail at GH¢720.

According to the GRA, when input VAT deductions are correctly applied, the new VAT regime should lead to lower, not higher, consumer prices.

“The appearance of higher prices is the result of traders applying the new 20% output VAT on top of a cost base that still includes non-deductible input VAT,” the statement said.

The Authority clarified that under the new system, businesses are required to declare both input and output VAT in a single return and pay only the difference.

VAT threshold increase

The GRA also addressed concerns about the increase in the VAT registration threshold to GH¢750,000, which some traders claim could distort competition.

The Authority disagreed, explaining that traders who are not VAT-registered still pay 20 percent VAT on their purchases but cannot claim deductions. In contrast, registered traders recover input VAT and therefore operate from a lower cost base.

Using the same GH¢500 example, the GRA indicated that both registered and non-registered traders would ultimately sell the item at GH¢720, emphasizing that the higher threshold is meant to ease the compliance burden on small businesses rather than create an uneven playing field.

Features of the new VAT system

The GRA highlighted several advantages of the revised VAT structure, including:

• A reduction in the effective tax rate from 21.9 percent to 20 percent.

• The removal of the 1 percent COVID-19 Health Recovery Levy.

• Full input VAT deductibility, including NHIL and GETFund components.

• The elimination of cascading tax effects, often referred to as “tax-on-tax.”

• Reduced operational costs due to the removal of embedded VAT from pricing.

• A more streamlined and unified VAT structure.

• An increased registration threshold to reduce administrative pressure on small-scale traders.

The Authority further noted that under the old system, the cost of a GH¢500 item rose to GH¢609.50 due to embedded VAT, whereas under the new regime, the cost remains GH¢500, representing nearly an 18 percent reduction.

Transitional pricing challenges

The GRA maintained that recent price increases being observed in the market are not a direct result of the policy changes but rather transitional pricing mistakes.

“The price increases currently being observed are the result of a failure to remove now-deductible input VAT from cost calculations,” the Authority stated.

To help traders adjust to the new system, the GRA revealed that it has formed a joint technical team with the Ghana Union of Traders’ Associations (GUTA). The team is tasked with providing guidance on VAT record-keeping, how to properly claim input VAT, and how to structure prices correctly under the new framework.

The Authority added that it is willing to extend similar technical support to the Abossey Okai traders and other trade groups to ensure a smooth transition to the new VAT regime.

AK/MA

Understanding Ghana's stock market and how to invest | BizTech