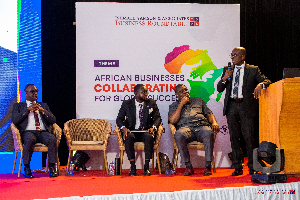

Kwabena Boateng, (extreme right) during his presentation

Kwabena Boateng, (extreme right) during his presentation

Kwabena Boateng, Divisional Director, Corporate and Institutional Banking at Fidelity Bank Ghana, emphasized the critical role of digital transformation and collaboration in shaping the future of banking and African business at the recently held Ishmael Yamson & Associates Business Roundtable 2024.

Themed "African Businesses: Collaborating for Global Success," the event underscored the importance of leveraging technological advancements and strategic partnerships to drive growth and competitiveness.

In his address, Kwabena, highlighted the rapid digital transformation sweeping across Africa, fuelled by a growing population, increased mobile phone penetration, and significant internet user growth. He pointed to Ghana as an example.

"Over the past decade, internet users in Ghana have grown from 5.3 million to approximately 24 million, indicating the deep integration of internet usage in society. The critical question now is how we utilize this data effectively to drive digital banking," Kwabena remarked.

Highlighting the shift towards digital financial transactions, he noted that while 40% of Ghanaians have bank accounts, many remain dormant. Conversely, 60% of Ghanaians use mobile money, reflecting the impact of internet connectivity on financial transactions.

"In the past year, 64% of Ghanaians initiated digital payments, signalling a significant shift from traditional banking to digitization. However, debit card usage remains low at around 18%, due to the prevalence of mobile money," He noted.

Kwabena Boateng emphasized the necessity of collaboration among African companies. "No business can thrive in isolation, especially in a country where only 38% of people have bank accounts. To grow, we must consider the broader African market," he stated.

He highlighted the success of Ghanaian company ZeePay, which recently acquired a 51% stake in a Zambian company, as an example of the importance of regional expansion and collaboration. ZeePay's operations across 20 African countries and over $3 billion in facilitated transactions demonstrate the global potential of African companies.

Kwabena applauded the rise of African FinTech companies like M-Pesa, EcoCash, Flutterwave, Paystack, Leatherback, and Onafriq. These companies, along with Agritech solutions like Complete Farmer and Aerobotics, are revolutionizing financial services, cross-border payments, and agricultural productivity across the continent.

Fidelity Bank itself embodies the collaborative spirit. The bank actively collaborates with FinTech companies like Insano, ExpressPay, ZeePay, and ITC. He emphasized, "This mutual dependency between banks and FinTechs will drive the agenda of business collaboration in Africa, leading to global success."

Despite the optimistic outlook, he acknowledged challenges faced by African businesses, including limited access to finance, underdeveloped infrastructure, and regulatory limitations.

Kwabena outlined a roadmap for greater success. He emphasized the importance of collaboration, both within the private sector and with governments.

"Strategic partnerships can be a game-changer for African businesses," he stressed. "Imagine the possibilities if telecommunication companies join forces with local fintech startups, replicating the success of M-Pesa by Safaricom. This could lead to groundbreaking mobile banking solutions across the continent."

He also highlighted the crucial role of governments in creating an enabling environment. "Collaboration on critical infrastructure projects, like transportation and energy, is essential," Kwabena said. "The Rwanda Innovation Fund serves as a shining example of how public-private partnerships can support innovation and technology hubs."

Trade policies also came under his spotlight. "Supportive policies that promote openness and reduce barriers are key to facilitating cross-border trade and investment," he explained. "Regional trade agreements and initiatives like ECOWAS and AfCFTA represent significant steps toward economic integration and collaboration."

Fidelity Bank's participation in the Ishmael Yamson & Associates Business Roundtable underscores its commitment to supporting the growth and success of African businesses. By embracing collaboration, innovation, and the opportunities presented by AfCFTA, African businesses can collectively achieve global success.