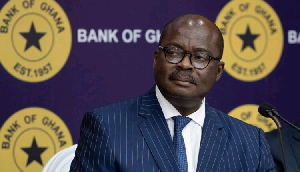

Dr. Ernest Addison, the Governor of the Bank of Ghana, has shed light on the circumstances surrounding the revocation of UT Bank and Capital Bank's licenses in 2017. According to Dr. Addison, the International Monetary Fund (IMF) had made the revocation of the licenses a strict requirement for Ghana to receive financial support.

At the time, Ghana was facing significant economic challenges, and the IMF's support was crucial in stabilizing the economy. However, the IMF's conditions were clear: Ghana had to take decisive action to clean up its banking sector, which was plagued by insolvency, poor governance, and regulatory defiance.

Dr. Addison emphasized that the decision to revoke the licenses was not taken lightly. The Bank of Ghana had worked closely with the banks to address their challenges, but ultimately, it became clear that the banks were beyond redemption. The Governor noted that the banks' poor corporate governance and insolvency had put depositors' funds at risk, and it was the Bank of Ghana's duty to protect them.

The revocation of the licenses was a bold move, but it was necessary to restore stability to the financial sector. Dr. Addison pointed out that the decision had far-reaching consequences, including the protection of depositors' funds and the prevention of a broader financial crisis.

In the aftermath of the revocation, the Bank of Ghana worked tirelessly to ensure that depositors' funds were protected and that the banks' assets were resolved in an orderly manner. The Governor noted that the process was complex and challenging, but ultimately, it was successful in restoring stability to the financial sector.

Dr. Addison's revelations provide valuable insight into the circumstances surrounding the revocation of UT Bank and Capital Bank's licenses. The decision was not taken lightly, but it was necessary to protect depositors' funds and restore stability to the financial sector.

The Governor's comments also highlight the importance of good corporate governance and regulatory compliance in the banking sector. The collapse of UT Bank and Capital Bank serves as a cautionary tale about the dangers of poor governance and regulatory defiance.

In conclusion, Dr. Addison's revelations provide a nuanced understanding of the circumstances surrounding the revocation of UT Bank and Capital Bank's licenses. The decision was a difficult one, but it was necessary to protect depositors' funds and restore stability to the financial sector.