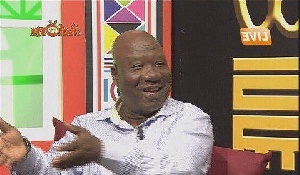

Bernard Allotey Jacobs, Central Regional Chairman of NDC

Bernard Allotey Jacobs, Central Regional Chairman of NDC

Central Regional Chairman of the National Democratic Congress (NDC), Bernard Allotey Jacobs has described as too quick the takeover of UT and Capital bank by GCB Bank Ltd.

“The Bank of Ghana has turned into American Marines . . . all of a sudden we heard the Governor of BoG has directed that the GCB should take over . . .” he said.

He was of the view that Ghanaians especially customers of the two banks should have been informed that the two banks were distressed and that they will be closed down.

Contributing to a panel discussion on Peace FM's morning show ‘Kokrokoo’, Wednesday, Allotey Jacobs said: They (BoG) shouldn’t take us for a ride . . . all of a sudden they decided that GCB should take over without the knowledge of Ghanaians, even the shareholders of both UT Bank and Capital Bank . . . they should make things clear . . . as the days pass by we will all see what will happen.”

According to him he is not surprised the GCB Bank is saying some workers of the two defunct banks would be laid off as a result of the takeover.

He used the takeover of then Merchant Bank by Fortiz Private Equity Fund Ltd. and rebranding it to the Universal Merchant Bank (UMB) as an example.

According to him the NPP used the sale of Merchant Bank for politics which nearly collapsed the country's financial market, then further accusing the then President's brother, Ibrahim Mahama of causing its collapse.

" We never listened to the NPP . . . the NDC government used a well thought measure, method and now look at how UMB is performing, it is progressing and their brand is superb. It took the wits and wisdom of our financial experts, the then Minister for Finance and his deputies turned around the fortunes of Merchant Bank . . . it is one of the vibrant banks in Ghana now," he stated.

He said the Minority in parliament following its press conference on Tuesday by former Deputy Finance Minister, Cassiel Ato Forson just reminded the Governor of the Bank of Ghana and educated Ghanaians on certains Legislative Instruments and acts passed in pariament which protect the deposits of customers and also protects the banks.

"We are reminding government, we are not doing politics with it," he said on Peace FM's 'kokrokoo' Wednesday morning.

Fortiz Private Equity Fund Ltd, a wholly owned Ghanaian equity fund reached an agreement with the Social Security and National Insurance Trust (SSNIT) and SIC Life to take over the majority stake in Merchant Bank Ghana Ltd on 1st November, 2013.

Under the terms of the Agreement, the acquisition includes the nonperforming loans in Merban Assets Recovery Trust.

In a statement released by the Bank of Ghana, Fortiz Private Equity Fund Ltd. will inject adequate capital to address the solvency and liquidity challenges facing the bank and implement a turnaround strategy to ensure

that the bank continues to operate normally.

The strategy includes listing the bank on the Ghana Stock Exchange within three years.

The Bank of Ghana reviewed the Agreement of the parties and granted its approval.