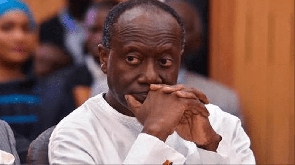

Ken Ofori-Atta is the Minister for Finance

Ken Ofori-Atta is the Minister for Finance

The Cabinet of the Government of Ghana, led by President Nana Addo Dankwa Akufo-Addo, has unanimously agreed to cancel the 15% Value Added Tax (VAT) on a section of electricity consumers, Asaase News reports.

According to the Accra-based media house, this decision was taken at a cabinet meeting held on Friday, February 2, 2024.

The report indicated the decision to charge the VAT was part of measures to raise government revenue as part of the International Monetary Funds (IMF) bailout programme the country is undergoing.

It said that the government has agreed to dialogue with the IMF to come to a consensus on how it can make up for the revenue shortfall occasioned by the decision cancellation of the VAT on electricity policy.

The report indicated that the government intends to now cut down its expenditure to make up for the shortfall in revenue.

Asaase News stated that its sources familiar with the cabinet decision has indicated that the final decision on completely cancelling the VAT on electricity policy would be reached after the engagement with the IMF.

“The position currently is that the 15% VAT on electricity is off, and it is likely it could either be off totally or significantly slashed,” the Asaase News sources are quoted to have said on condition of anonymity.

Background:

A leaked letter from the Ministry of Finance showed that the government has been changing Value Added Tax (VAT) on a section of electricity consumers in the country since the beginning of January 2024, which infuriated a lot of Ghanaians including organised labour who have threatened to embark on strike action if the tax is not scrapped.

The letter, which was signed by the Minister for Finance, Ken Ofori-Atta, and addressed to the Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO), indicated that the VAT would be for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units.

It said that VAT forms part of the implementation of the country’s Covid-19 recovery programme and should be charged starting from January 1, 2024.

“As part of the implementation of the Government's Medium-Term Revenue Strategy and the IMF-Supported Post Covid-19 Programme for Economic Growth (PC-PEG), the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units in line with Section 35 and 37 and the First Schedule (9) of Value Added Tax (VAT) Act, 2013 (ACT 870) has been scheduled for implementation, effective 1st January 2024.”

“For the avoidance of doubt, VAT is still exempt for "a supply to a dwelling of electricity up to a maximum consumption level specified for block charges for lifeline units" in line with Sections 35 and 37 and the First Schedule (9) of Act 870,” the letter further clarified.

BAI/OGB