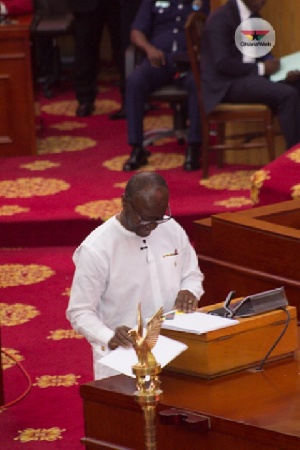

Finance Minister, Ken Ofori Atta on the floor of Parliament

Finance Minister, Ken Ofori Atta on the floor of Parliament

Barring any last-minute hitch, four tax cuts announced in the 2017 budget will be passed by Parliament today.

Finance Minister, Ken Ofori-Atta, and his team yesterday submitted the amendment bills of some four laws to parliament to allow for government’s tax cuts.

The bills were read for the first time on the floor and referred to the Parliamentary Select Committee on Finance.

The Parliament Select Committee on Finance met with the Finance Minister and his team before the close of day yesterday and the Committee considered the bills.

It is expected that the bills will be read in the plenary today and passed under a certificate of urgency.

The bills include: the Income Tax (Amendment), Special Petroleum Tax (Amendment), Special Import Levy (Amendment), and a repeal of the Custom and Excise (Petroleum Taxes and Petroleum Related Levies).

Special Petroleum Tax (Amendment) Bill 2017

Special Petroleum Tax (Amendment) Bill 2017 will reduce the special petroleum tax rate from 17.5 per cent to 15 per cent.

Special Import Levy (Amendment) Bill 2017

Special Import Levy (Amendment) Bill 2017 will scrap the one percent Special Import Levy.

Income tax (Amendment) Bill 2017

Income tax (Amendment) Bill 2017 will commence a process for corporate income tax to be progressively reduced from 25 percent to 20 percent in 2018.

Customs and Excise Repeal Bill 2017

The Finder learnt when the bills are passed, President Nana Akufo-Addo, who has said he is in a hurry to fix the economy, is expected to accent his signature to it before the close of this week.

List of tax cuts

The Finance Minister who made this known during his presentation of government's first budget listed them as follows:

(a) Abolishment of the one percent special import levy,

(b) Abolishment of the 17.5 VAT on financial sevices

(c) Abolishment of the 17.5% VAT on selected imported medicines

(d) Initiate steps to remove import duties on raw materials and machinery

(e) Abolishment of the 17.5 VAT on domestic airline tickets

(f) Abolishment of the 5% VAT on real estates

(g) Abolishment of the excise duty on petroleum

(h) Reduce special petroluem tax rate from 17.5% to 15%

(i) Abolishment of duties on importation of spare parts.

(j) Abolishment of levies imposed on Kayayei's by local authorities

(k) Replace the 17.5 VAT on Ghana Stock Exchange (GSE) traders to a flat rate of 3.5 percent

(l) Reduce National Electrification levy

The only way for some of the cuts to take effect would be for government to make amendments to some key laws, hence the submission of the amendment bills to the House by the Minister.

Mr Ofori-Atta is optimistic that the measures outlined in the budget would help ensure efficiency in revenue collection and offset any shortfalls because of tax reliefs.

He said government was sure to increase revenue through the reduction in tax exemptions and plugging of loopholes, which could help the Ghana Revenue Authority to collect 33 per cent more revenue in 2017.

The Ghana Revenue Authority (GRA) has allayed fears of the public that the tax incentives announced by the Finance Minister in the 2017 Budget would hinder its tax collection efforts.

Mr Emmanuel Kofi Nti, the Acting Commissioner-General of the GRA, said “we believe it would reduce the cost of operations of businesses and make them more competitive to expand and generate more dividends, which would eventually make them receptive towards payment of taxes”.